Hi Frens – Naga & Chiron here with some thoughts around the US tax implications of OHM and Klima from a staking and capital gains perspective. We are very excited about these two protocols and are actively working with the Olympus DAO protocol on various matters.

In fact, one of the reasons that this Post had gotten delayed so long is that we were preparing content for an Olympus Agora TV Episode on matters related to taxation and Naga participated in the panel discussion. The video for that event can be found on YouTube and is linked below.

While we were able to hit the high points during that discussion, we wanted to further develop the thoughts and concepts outlined in greater detail. By adding additional context, we hope that readers from other countries will be able to relate the concepts to the specific tax rules within their jurisdictions so that they might be able to appropriately discuss with their tax advisors.

If you haven’t already realized it, we are fond of providing a framework through which to view cryptocurrency transactions. While some of this might already be well known to you, through questions we have received via Twitter or in various Discords that we are active in, it seems like those that read us have varying degrees of knowledge so we feel more comfortable starting at the introductory level.

For purposes of this post we are going to focus on the concept of staking OHM and Klima and its resultant impact on the calculation of capital gains or losses should the holder decide to exit the position.

Staking 101:

It is likely that most new crypto enthusiasts will get exposed to the concept of staking through the purchase of certain cryptocurrencies on a centralized exchange such as Coinbase. Holders of coins as diverse as ETH and XTZ can earn an APY of 2-5%, or even more in some cases, and the exchange handles all of the messy stuff behind the scenes.

As with many other crypto tax issues, the IRS hasn’t specifically issued guidance on how to handle staking transactions so we are once again working from first principles. Within the tax law, there is a hierarchy of support starting with the Internal Revenue Code, Treasury Regulations, and Court cases at the top of the heap. Guidance stemming from items like Frequently Asked Questions (“FAQs”) are among the lowest forms of authoritative support. Naturally, most of the support we have received so far is in the form of a slowly expanding list of FAQs.

In the absence of formal guidance, we look to what type of transaction where guidance does exist in order to attempt to come up with a reasonable approach. From the perspective of the investor, staking on a centralized exchange or through a wallet such as Vauld, Trust, or Exodus most closely resembles the receipt of interest or dividends if we are thinking about the transaction in TradFi terms. Various platforms will likely offer different APYs as well for the same coin. Accordingly, the consensus within the crypto community for these types of investments has become that any such staking rewards are treated as taxable income upon receipt.

Staking OHM and Klima:

So….with regards to OHM and Klima, does that mean we can leverage the above and we’re done with our analysis since Ohmies and Klimates also receive staking rewards based upon their holdings?

Sorry to break it to you, but the staking rewards received from OHM and Klima have some unique characteristics that need to be appropriately considered in order to reach a reasonably supportable position.

The more significant variances between the two staking situations are as follows:

Unlike the scenario described above, all OHM and Klima investors receive the same reward percentage whereas other staking mechanisms provide different rates based upon the platform;

OHM and Klima are staked within the protocols themselves and not on a third party staking as a service provider;

The OHM and Klima staking rewards received by an investor represent their share of a proportionate increase in the amount of total OHM and Klima in circulation which is not the case in the scenario described above. This is due to the rebasing nature of these particular crypto currencies.

As tax practitioners, we need to focus on the specific facts and circumstances and thus need to consider whether these variances have any impact on the crypto staking analysis that has been done previously.

With regards to these variances, the first and last are intertwined and are of key importance. Having the same rate of return for everyone receiving staking rewards is an indication that something different might be going on here. If earning staking rewards on ETH, we can easily see that the rates received across platforms are not consistently uniform. With OHM and Klima, however, the rate is the same for all stakers. A staker of ETH is simply receiving additional ETH but the receipt of that ETH is not proportionately distributed to all stakers. The overall supply of ETH is not increasing in synch with the receipt of the staking rewards by an individual investor.

For an Ohmie or Klimate, however, all stakers receive rewards at the same rate which is due to the fact that the underlying currency is actually undergoing a “rebase” each time that staking rewards are distributed. A rebase is mechanism through which the protocol has minted new coins (expanding the available supply) and since the value of the circulating coins are pegged 1:1 with the value of the staked coins, investors that have staked coins with the protocol also need to receive a proportionate increase to their staked balance to keep everything in synch.

Now that we understand some potentially significant differences arising from the change in facts, we need to put our TradFi hat back on to see if staking OHM and Klima still most closely resemble the receipt of interest or dividends. Based upon our identification of the variances and our analysis, it would seem that it does not. Given the rebasing mechanism, the receipt of OHM/Klima staking rewards most closely resembles a stock split – an unusual one, understandably as they happen roughly every eight hours and are spread like peanut butter.

Stock splits do not impact the underlying economics or entity capitalization in any way, but simply increases the number of shares that those values are spread across. Stock splits do not result in a taxable event requiring the recognition of income currently, but they do require adjustments to the cost basis of our holdings which we will outline below.

We wish to make clear that this treatment is speculative as we do not have formal guidance from the IRS on this, but we wanted to share this concept so that each holder to can evaluate it based upon their individual facts and circumstances in conjunction with their tax advisor.

Calculating Capital Gains / Losses:

Assuming that treating OHM/Klima staking rewards as stock splits by analogy is a reasonable approach, we need to come up with a way to effectively calculate the adjusted tax basis. In a FAQ, the IRS provides guidance on how that should be handled when it comes to shares of stock. We have reproduced the guidance below as we will be leveraging the concepts while also providing a framework for OHM and Klima.

Question

How do I figure the cost basis of stock that split, which gave me more of the same stock, so I can figure my capital gain (or loss) on the sale of the stock?

Answer

A stock split occurs when a company creates additional shares, thus reducing the price per share. If you own stock that has split and now own additional shares, you must adjust your basis per share or per the lots of the stock you own.

If the old shares of stock and the new shares are uniform and identical:

Allocate the basis of the old shares to the old and new shares.

Determine the per share basis by dividing the adjusted basis of the old stock by the number of shares of old and new stock.

If you purchased the old shares in separate lots for differing amounts of money (a different basis per share in different lots):

Allocate the adjusted basis of the old stock between the old and new stock on a lot by lot basis. Example: Suppose you have 200 shares of XYZ Inc. common stock. You initially bought 100 shares at $10 per share. You later bought another 100 shares at $12 per share. XYZ Inc. announces a two for one stock split and issues you 200 additional shares. You update your records. The first lot of 100 shares is now 200 shares. Your total basis in the 200 new shares is the same $1,000 basis you had in the 100 shares before the split. The new per share basis is $5 ($1,000/200 = $5). Similarly, your second lot of 100 shares is now 200 shares. Your total basis in these 200 new shares is $1,200, the same as your basis in the 100 shares before the split. The new per share basis is $6 ($1,200/200 = $6).

Pretty straightforward and easy right? We hate to break it to you, but it gets a wee bit more complex as we transition to thinking about it in the context of OHM/Klima.

The rebasing nature of OHM and Klima necessitates knowing a few additional pieces of information other than the obvious ones noted above when it comes to adjusting stock basis. Whether it is stock, OHM, or Klima, we can easily make note of our initial cost basis in order to establish our starting point. As a reminder, don’t forget to track the ETH gas fees that were paid to either acquire or dispose of OHM and Klima as those amounts are also includable in the basis calculation.

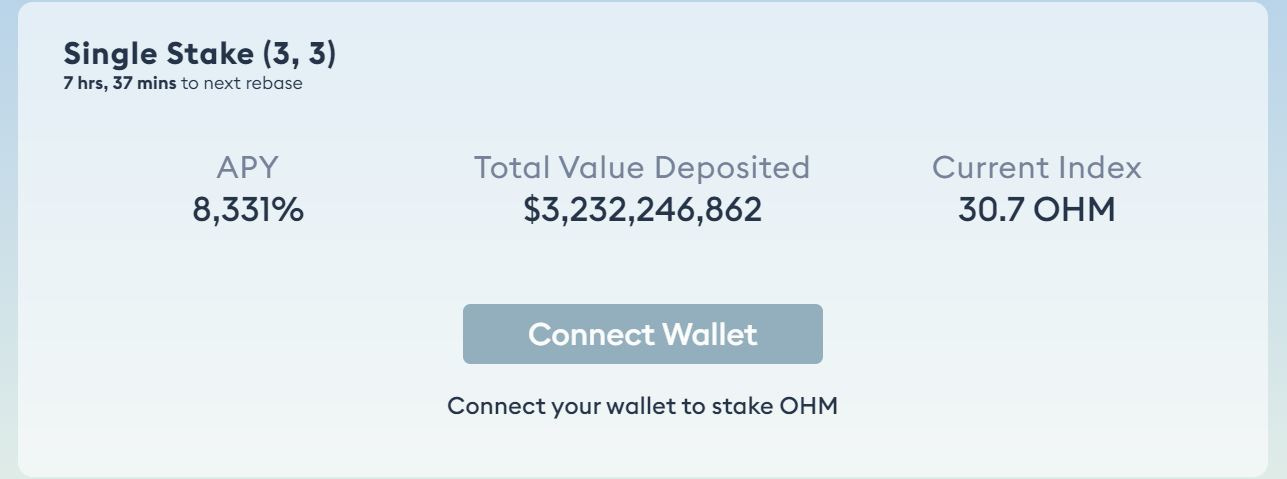

The first crucial piece of additional information needed when performing the calculation for OHM or Klima is what the current index is at the time of staking. We have included below a screenshot of the Olympus Staking Dashboard (https://app.olympusdao.finance/#/stake) at the time of writing for illustrative purposes.

You should always make note of the relevant current index when you initiate staking as that will greatly simplify calculating your adjusted basis in the future. Knowing this information will be absolutely essential should you invest in either protocol in multiple tranches as we will illustrate below.

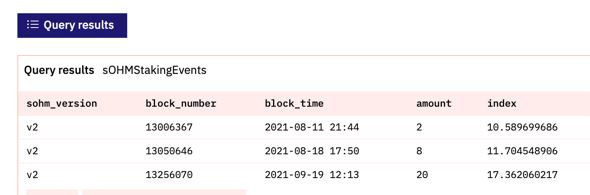

So what do you do if didn’t know how important the index was and didn’t make note of it? Luckily if you’re an Ohmie, there is a query (https://dune.xyz/queries/166737) that has been written that will provide you with the exact current index each time a particular wallet staked Ohm and we have reproduced below some actual wallet data that will be used to develop illustrate sample capital gain transaction calculations.

As an aside, if any of our gentle readers know SQL, it is our understanding that the above query could be easily modified to support Klima as well.

The sample shows three different staking events that took place on different days and in different amounts. For purposes of keeping the math easy, let’s use the following as the relevant USD amounts involved (values include gas fees as appropriate):

Current Price of OHM - $1,000 (net of unstaking and selling related gas fees)

Total Cost Basis 8/11/2021 - $850 with a per coin basis of $425

Total Cost Basis 8/18/2021 - $2,200 with a per coin basis of $275

Total Cost Basis 9/19/2021 - $11,500 with a per coin basis of $575

In order to determine how much to each tranche has grown due to the rebases compounding, we need to calculate a ratio. As the Dashboard’s Current Index only shows one decimal point, we will only use that for the entry point as well in order to be consistent.

8/11 Tranche: (30.7 / 10.6) = 2.89 X 2 OHM = 5.78 coins for an adjusted per coin basis of $147 (850 / 5.78).

8/18 Tranche: (30.7 / 11.7) = 2.62 X 8 OHM = 20.96 coins for an adjusted per coin basis of $105 (2,200 / 20.96).

9/19 Tranche: (30.7 / 17.4) = 1.76 X 20 OHM = 35.20 coins for an adjusted per coin basis of $327 (11,500 / 35.20).

Accordingly, the total staked OHM after rebases would be 61.94 compared to the purchased OHM balance of 30.

Now let’s say that the Ohmie in question has decided to unstake and sell OHM under various scenarios. Various methodologies are available in terms of actually calculating the amount of capital gain to be recognized. For example, the Ohmie could use FIFO (first in, first out), LIFO (last in, last out), or even HIFO (highest in, first out).

Liquidate Entire Position:

If liquidating the entire position (currently 61.94 OHM), we don’t need to determine the adjusted cost basis per coin. Instead, we can simply calculate the gain by taking the gross proceeds and subtracting the original cost basis to arrive at a gain of $47,390 ((1,000 X 61.94) – (850 + 2,200 + 11,500)).

Liquidate 40 OHM on a FIFO Basis:

This transaction would impact all three tranches by removing all of them from the first acquisitions and a portion of the last acquisition. The breakdown of the gain calculation is as follows:

Proceeds: $40,000 - (40 X 1,000)

FIFO Layer 1 Cost: ($850) - entire layer is being sold

FIFO Layer 2 Cost: ($2,200) - entire layer is being sold

FIFO Layer 3 Cost: ($4,336) - (13.26 coins X 327)

Capital Gain: $32,614

Liquidate 40 OHM on a LIFO Basis:

This transaction would impact two of the three tranches by removing all of them from the most recent acquisition and a portion from the second acquisition. The breakdown of the gain calculation is as follows:

Proceeds: $40,000 - (40 X 1,000)

LIFO Layer 1 Cost: ($11,500) - entire layer is being sold

LIFO Layer 2 Cost: ($504) - (4.8 coins X 105)

Capital Gain: $27,996

Liquidate 40 OHM on a HIFO Basis:

This transaction would impact two of the three tranches by removing all of them from the most recent acquisition and a portion from the first acquisition. The breakdown of the gain calculation is as follows:

Proceeds: $40,000 - (40 X 1,000)

HIFO Layer 1 Cost: ($11,500) - entire layer is being sold

HIFO Layer 2 Cost: ($706) - (4.8 coins X 147)

Capital Gain: $27,794

The Ohmie would recognize the most gain utilizing a FIFO approach and the least amount of gain using the HIFO approach as one would expect. Being able to track acquisitions by tranche makes it much easier to determine which methodology is the most optimal and also provides the appropriate level of support should the transaction be examined by a tax authority.

Tax Deferred or Tax Free?

Now if we really want to have some fun and perhaps annoy various Congress Critters and their staff at the same time, we might decide to stake OHM or Klima within a Self-Directed IRA/LLC. If able to utilize a Roth IRA/LLC for this purpose, then those capital gains would accrue tax free under current law.

If you do not already have a Self-Directed IRA/LLC structure in place, we’re actually in the process of talking with a couple of top-tier providers in order to arrange a group buy as a way to pass along some savings to those interested in forming one before the end of the year.

If you would be interested in learning more about the group buy, send us an email, comment below, or send us a DM on Twitter (https://twitter.com/BowTiedNaga and https://twitter.com/BowTiedChiron).

Feedback Requested:

Gentle readers – We’d like some feedback from you with regards to the content of this post. Our thoughts are that this is around the level of detail that we would target for our paid subscriptions once we move to that model. Does this content align with what you would expect from a paid subscription? We’re truly interested in your thoughts on this matter. Feel free to comment below or send us an email.

WAGMI

This post is for entertainment and educational purposes only. It does not constitute accounting, financial, legal, or tax advice. Please consult with your advisor(s) regarding your personal accounting, financial, legal, and tax matters.

Y'all need to setup shop. So many folks are going to need crypto tax help and near no one currently provides.

Thank you for this post and for the "TradFi" comparisons - very helpful.

Question on taxable events upon recipient. Example: Staking $DOT and getting "paid" your yield in $DOT daily and let's say $DOT prices goes to $0.01 the following week, never recovers.

I owe tax on the daily payments of $DOT yield as if I was paid a dividend? And I owe at whatever the $DOT to USD rate is at that time? Even if that assent later goes to zero?

My contention is I was not paid in USD, as I would be with a dividend.

Can’t believe this post is free. Perfect explanation and level of detail.

I’m a CPA too—although tax is not my focus.

Staking Sushi and Spell. Thinking of treating these as purely capital gain/loss from IRS prospective because there is no realizable event just holding xSushi and sSpell. The rewards don’t passively post to your wallet on a periodic basis—only when you swap back to original token—which is when I plan on having a taxable event.

Sound reasonable or am I ngmi?